I am extremely privileged to present this website of Customs (Preventive) Zone, Delhi to the

members of trade and industry and to the general public.

As I am writing this message, our Country is celebrating “Azadi ka Amrit Mahotsav” on completion of

75 years of India’s Independence and Customs Department is celebrating 60th year of Customs Act,

1962. Being an integral part of Government of India and Customs Department; the Customs

(Preventive) Zone, Delhi is organizing various programs to celebrate the completion of 75 years of

India’s Independence and 60 years of Customs Act, 1962. Customs (Preventive) Zone, Delhi is also

committed towards its responsibility of collection of Indirect Taxes by monitoring the

anti-smuggling work and commercial fraud cases along with prevention of illegal import and export

of goods.

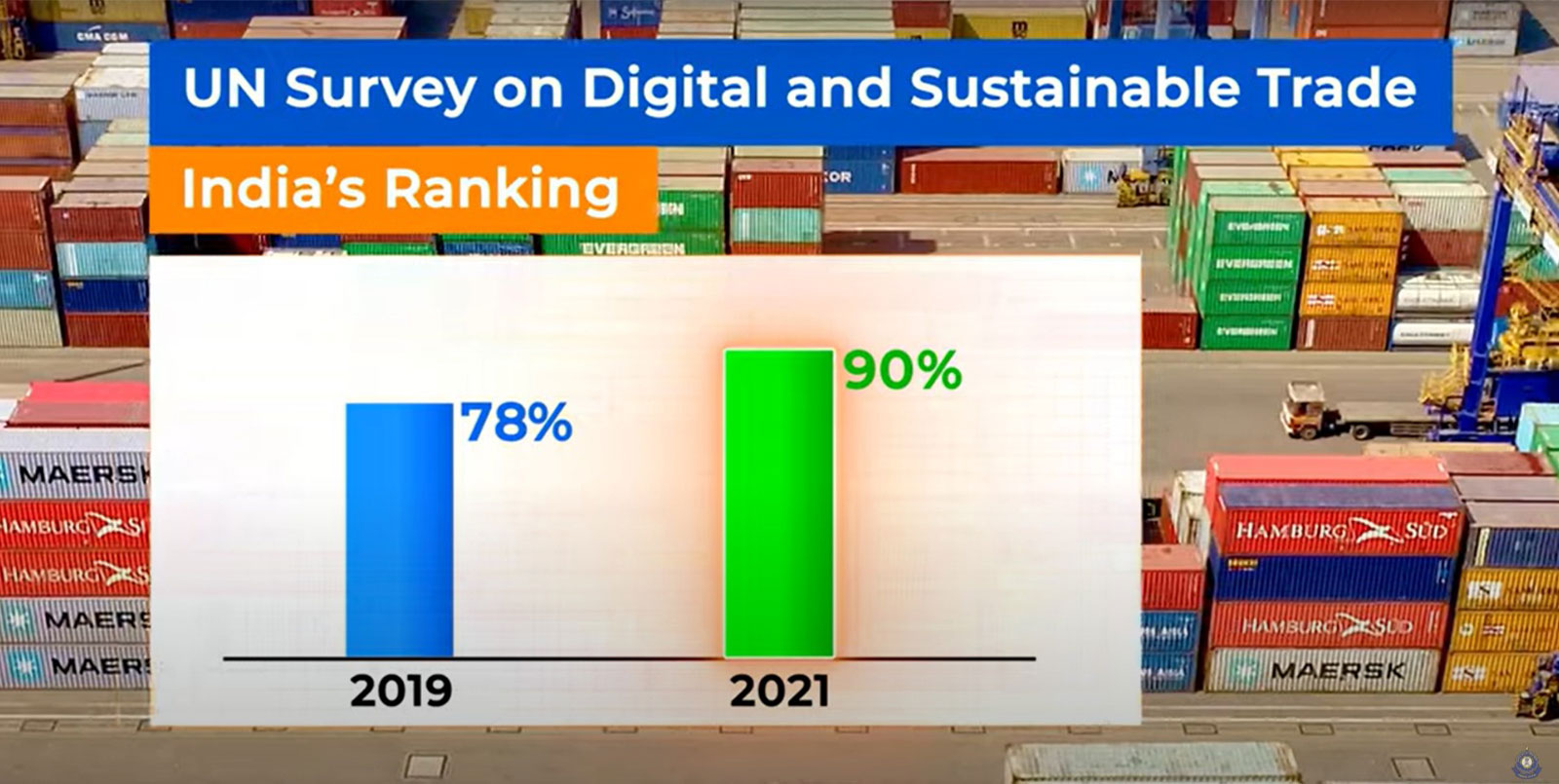

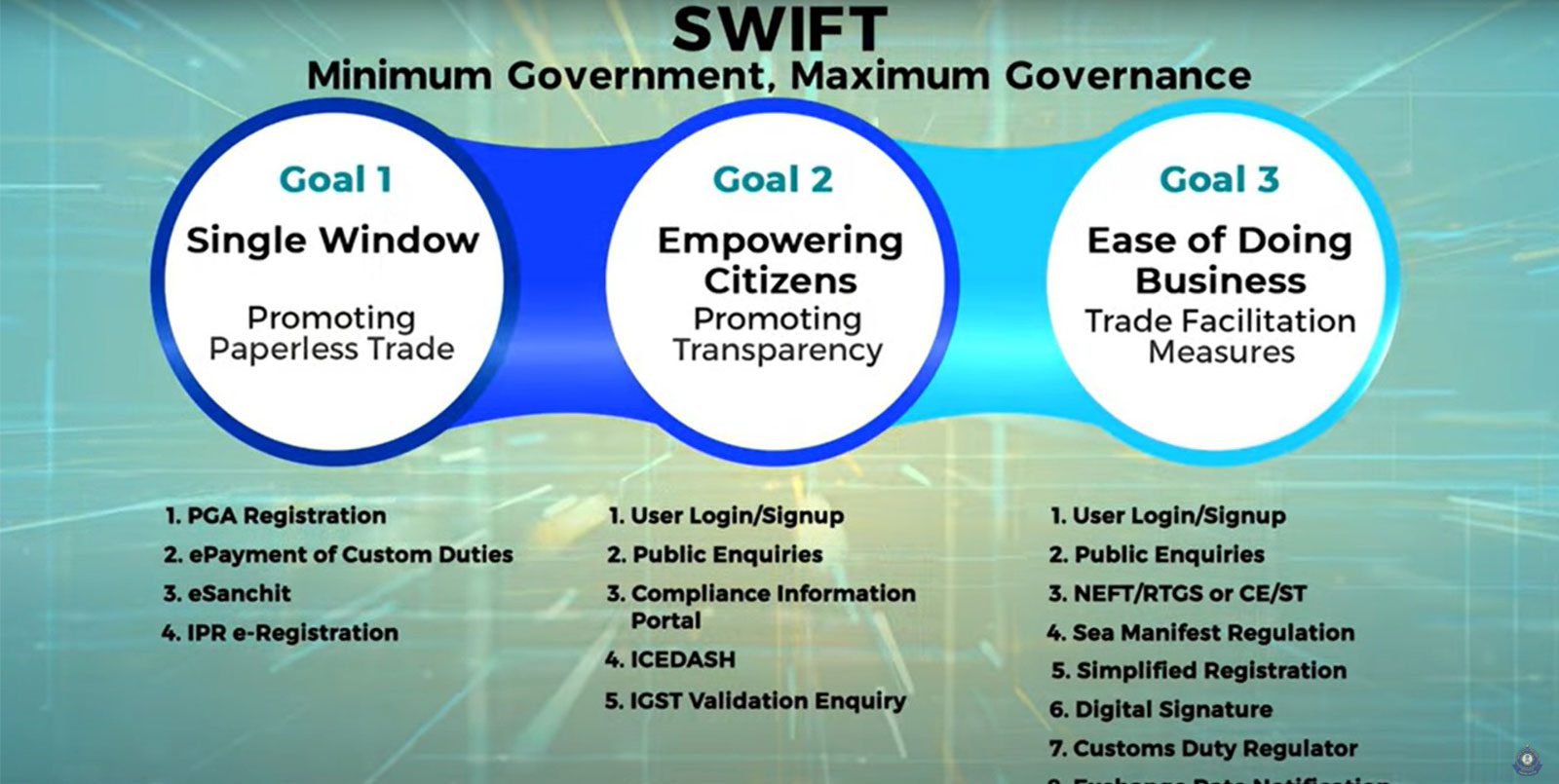

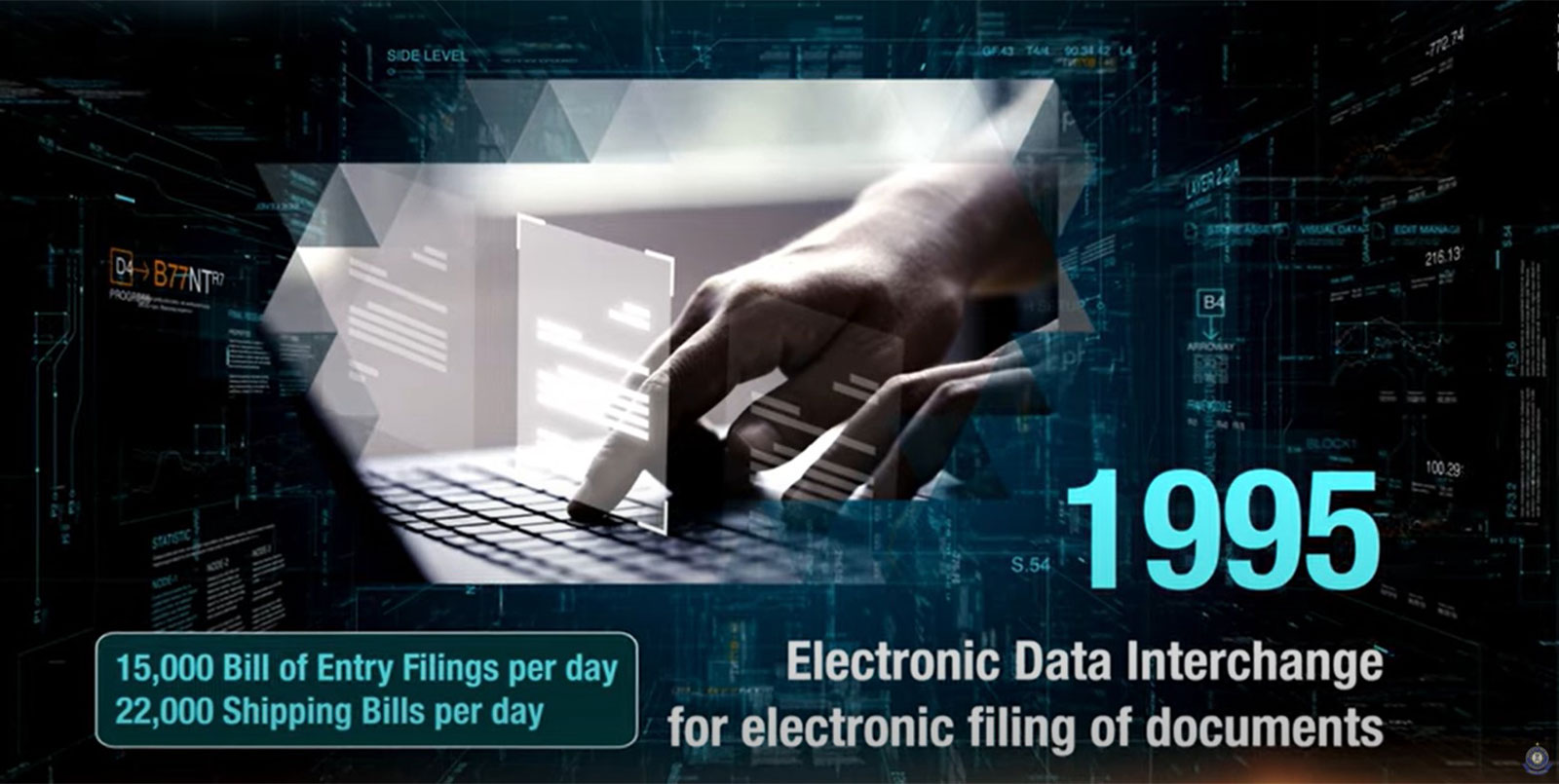

The need for a digital transformation in government services and especially in taxation, is well

appreciated and understood. This was also emphasized by the Hon’ble Prime Minister of India, Shri

Narendra Modi in the first Rajaswa Gyan Sangam, held in 2016, where he outlined the ‘RAPID’ charter

for tax administrators, hinging on five critical elements —Revenue, Accountability, Probity,

Information and Digitization.

Keeping on the words of our Hon’ble Prime Minister and to take a step forward in Digitization, this

website aims in providing real time information to the trade, industry and general public on

functioning of Customs (Preventive) Zone, Delhi. Customs (Preventive) Zone, Delhi is committed to

comply with all the five elements of ‘RAPID’ outlined for tax administrators by our Hon’ble Prime

Minister in 2016 i.e. Revenue, Accountability, Probity, Information and Digitization. Efforts have

also been made through this website to provide all relevant information on Customs and other

related subjects in easily accessible manner on a single platform.

I take the opportunity to convey my best wishes to my colleagues and taxpayers who will be

benefitted through this website. Your feedback and suggestions are always welcome for helping us in

serving you better.

-visit/home-Customs-Canine-Centre-(k-9)-visit1.jpg)

/home-Review-Meeting-Leh-(August)7.jpg)